The need for sustainable energy efficiency, availability, and security systems in the face of increasing population and declining fossil fuel reserves. The information is essential for anyone concerned about the future of energy.

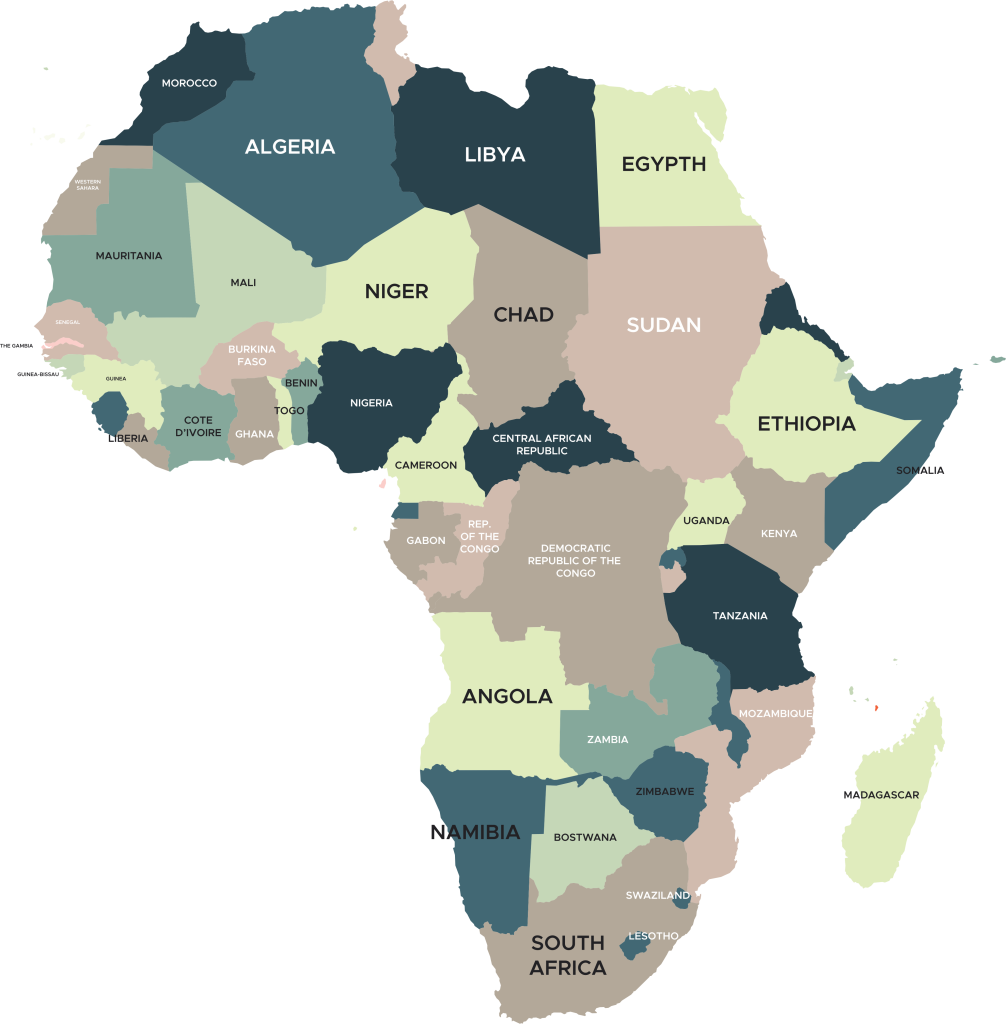

Africa boasts a wealth of renewable energy resources, including solar, wind, hydro, and geothermal power. These resources are largely untapped, presenting vast opportunities for investment. According to the International Renewable Energy Agency (IRENA), Africa has the potential to generate more than 10 terawatts of solar energy and 1,300 gigawatts of wind power, significantly surpassing its current energy demand.

Africa’s energy demand is soaring due to rapid population growth, urbanization, and economic development. The continent’s population is expected to reach 2.5 billion by 2050, driving increased energy consumption. The International Energy Agency (IEA) predicts that Africa’s energy demand will double by 2040, creating a substantial market for renewable energy investment.

Africa has witnessed a surge in large-scale renewable energy projects. The continent’s largest solar power plant, the Benban Solar Park in Egypt, with a capacity of 1.8 gigawatts, is a testament to Africa’s potential for renewable energy. Similar projects, such as wind farms and hydropower plants, are being developed across the continent, attracting international investors.

Approximately 600 million people in Africa lack access to electricity, primarily in rural areas. Off-grid renewable energy solutions, such as solar home systems and mini-grids, have emerged as viable alternatives to extend energy access. Investors are capitalizing on this opportunity to provide clean, affordable energy to underserved communities, combining social impact with financial returns.

African governments are demonstrating strong commitment to renewable energy through policy frameworks and incentives. Many countries have established renewable energy targets, feed-in tariff programs, and streamlined regulatory processes to attract investment. For instance, Morocco’s Noor Ouarzazate Solar Complex and South Africa’s Renewable Energy Independent Power Producer Procurement Program (REIPPPP) have successfully attracted significant private sector investment.

Improving governance, political stability, and favorable investment climates are key factors driving investor confidence in Africa’s renewable energy sector. Several countries have implemented reforms to ease the process of doing business and protect investor rights. Transparency International’s Corruption Perceptions Index shows that corruption levels in some African countries have significantly decreased, signaling improved business environments.

Africa’s renewable energy sector is brimming with potential, driven by abundant resources, rising energy demand, supportive governments, and favorable investment environments. The continent’s push towards sustainable development, coupled with increasing international support, has created an environment ripe for investors seeking both financial returns and the opportunity to make a significant positive impact.

By investing in renewable energy in Africa, individuals and businesses can contribute to the continent’s energy transition, promote economic growth, create jobs, and foster environmental sustainability. As Africa embraces renewable energy solutions, it is set to thrive as a major player in the global clean energy revolution.

In a period of uncertainty due to environmental or natural disaster there are serious economic consequences and pressure that produces inflationary and hyper-inflationary situations. Consistently, real assets protect best against the loss of purchasing power and also helps to act offer immediate support to citizens as well as victims of disaster

With an increasing population, the pressuer on Africa’s Energy infrastructure and security will have an advserse effect on already overwhelmed socio-economic stuctures. The need for an upgrade on our sustainable energy efficiency, availability and security systems is critical to our wellbeing. Energy commodities with few availability at local level will experience higher inflation.

World energy consumption is increasing at a great pace. Fossil energy reserves are declining, and supply will struggle to keep up with demand. Consequently, with lower oil prices, African economies will need a reset as it will have negative effect on energy supply, consumption and security sectors. This will drive needs for alternative energy sources as they will have to increase and in addition, opportunities for other energy ressources investment will be many.

With differing economies, governments and approaches to energy consumption, it’s impossible to summarise the efficiency and sufficiency of energy generation and distribution across the continent. But there are a number of African countries looking to impact positively in shoring up their energy supply and requirements.

Poor or lack of sustainable energy infrastructure may mean provision in rural and remote areas is sparse or non-existent. Major cities and tourist areas are heavily concentrated but with little electricity supply.

Africa’s energy companies are at an earlier development stage and therefore have better long-term growth prospects

Access is better than that of other markets and fiscal terms are generally better than in other regions offering growth

A fund is a vehicle that offers investors the opportunity to capitalize on expert resources. As an alternative investment fund with specific targets on some clean energy infrastructure and other related renewable energy projects that supports local industrries, the fund provides access to other institutional or individuals that are willing to support initiatives such as Komani Africa Fund.

A fund allows the investors to gain access to investments that it may otherwise be unable to invest in. In other words, sums invested with Komani Africa Fund will capture the essesnce of ‘real development’ whilst catering for those that require support. Its essence is to re-invest in profitable ventures that offer the capacity to provide jobs.

Holding shares in a fund is an efficient way to hold a pool of diversified investments. This is also an opportunity to see to the growth and management of well structured fund that meets the people’s needs.

A fund is a vehicle that offers investors the opportunity to capitalize on expert resources. As an alternative investment fund with specific targets on some clean energy infrastructure and other related renewable energy projects that supports local industrries, the fund provides access to other institutional or individuals that are willing to support initiatives such as Komani Africa Fund.

A fund allows the investors to gain access to investments that it may otherwise be unable to invest in. In other words, sums invested with Komani Africa Fund will capture the essesnce of ‘real development’ whilst catering for those that require support. Its essence is to re-invest in profitable ventures that offer the capacity to provide jobs.

Holding shares in a fund is an efficient way to hold a pool of diversified investments. This is also an opportunity to see to the growth and management of well structured fund that meets the people’s needs.

Copyright © 2023 K’omani Energies, All Rights Reserved.